This article emphasizes the critical importance of effectively navigating the pediatric device pathway in Mexico, leveraging the expertise of advisors well-versed in COFEPRIS regulations. Understanding regulatory requirements is paramount, as is the preparation of essential documentation. Engaging with local authorities and implementing post-approval strategies are vital steps to ensure compliance and to capitalize on emerging market opportunities. The projected growth of the pediatric medical equipment sector in Mexico further underscores the significance of these efforts.

Navigating the pediatric device landscape in Mexico presents a distinct array of challenges and opportunities for manufacturers. The pediatric medical equipment sector is on the brink of substantial growth, making it imperative to understand the regulatory framework established by COFEPRIS for success. This article explores essential strategies for engaging advisors who can facilitate the approval process, ensuring compliance while maximizing market potential.

How can stakeholders effectively leverage local expertise to surmount regulatory hurdles and seize this expanding market?

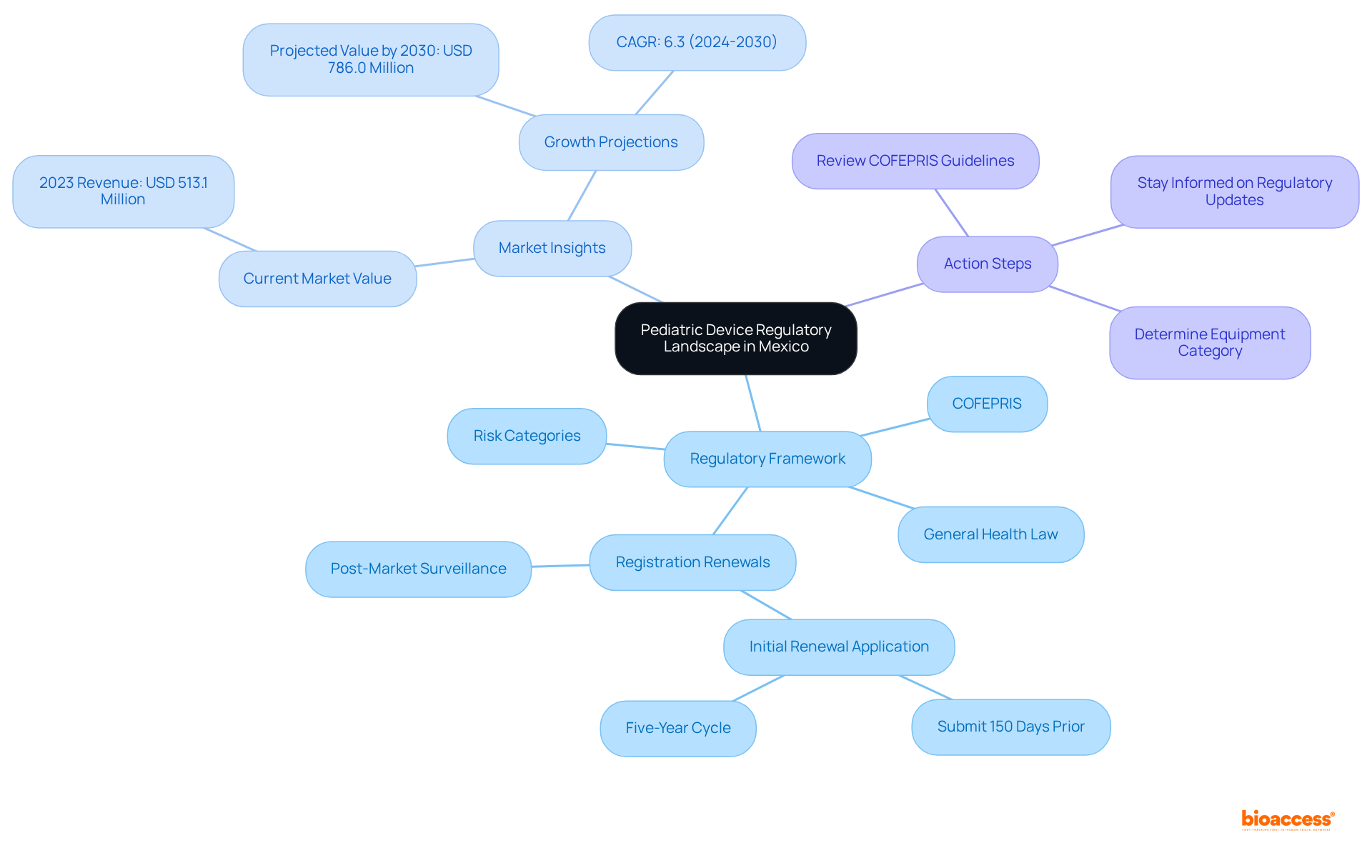

Navigating the pediatric device pathway in Mexico requires the guidance of advisors who have a comprehensive understanding of the regulatory framework overseen by COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios). This authority is responsible for the authorization and regulation of medical instruments, including those specifically designed for children. Key regulations include the General Health Law and specific directives tailored for children's equipment. Familiarity with the categorization of equipment is crucial, as items are classified into various risk categories, directly impacting the authorization process. Additionally, staying updated on recent regulatory modifications is vital, particularly those that may affect children's products, including insights from pediatric device pathway Mexico advisors regarding expedited pathways for items previously endorsed by recognized global authorities.

It is imperative to acknowledge that equipment registration renewals occur every five years, with the initial renewal application required to be submitted at least 150 days prior to the expiration of the current registration. Post-market surveillance mandates robust monitoring mechanisms for product performance and safety, ensuring adherence to COFEPRIS regulations. Moreover, securing a Certificate of Free Sale from the product's country of origin is essential for validating legal marketing in other regions. Manufacturers must also remain vigilant regarding potential penalties for failing to report serious adverse events within stipulated timeframes, as this represents a significant compliance consideration.

In 2023, the pediatric medical equipment sector in Mexico, guided by pediatric device pathway Mexico advisors, generated USD 513.1 million, with projections indicating growth to USD 786.0 million by 2030, underscoring the substantial opportunities within this domain. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030, emphasizing the necessity for strategic planning concerning compliance and market entry.

To effectively navigate this landscape, consider the following action steps:

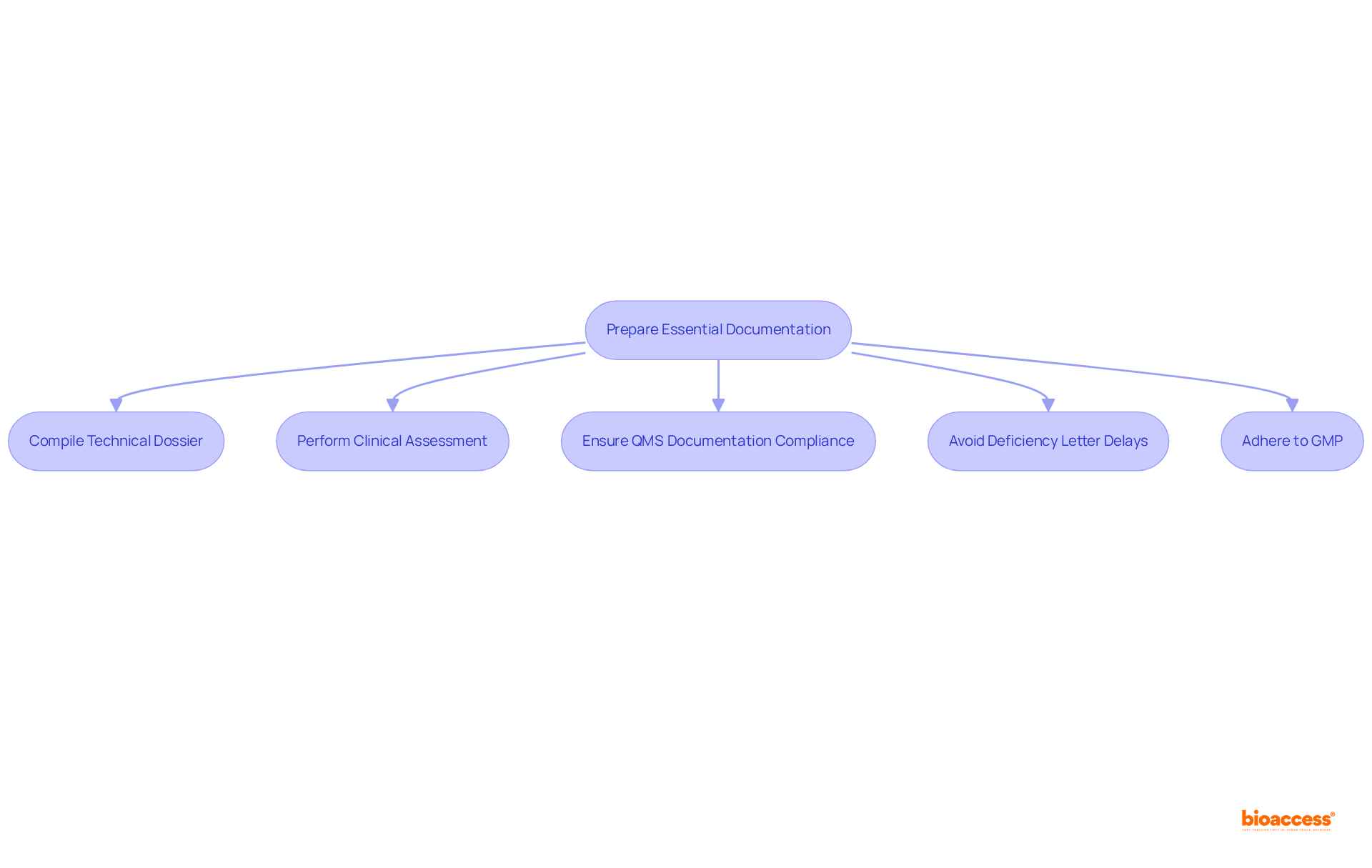

Preparing the required documentation is a crucial step in the pediatric device pathway Mexico advisors for the approval process of children's equipment. Key documents include:

Action Steps:

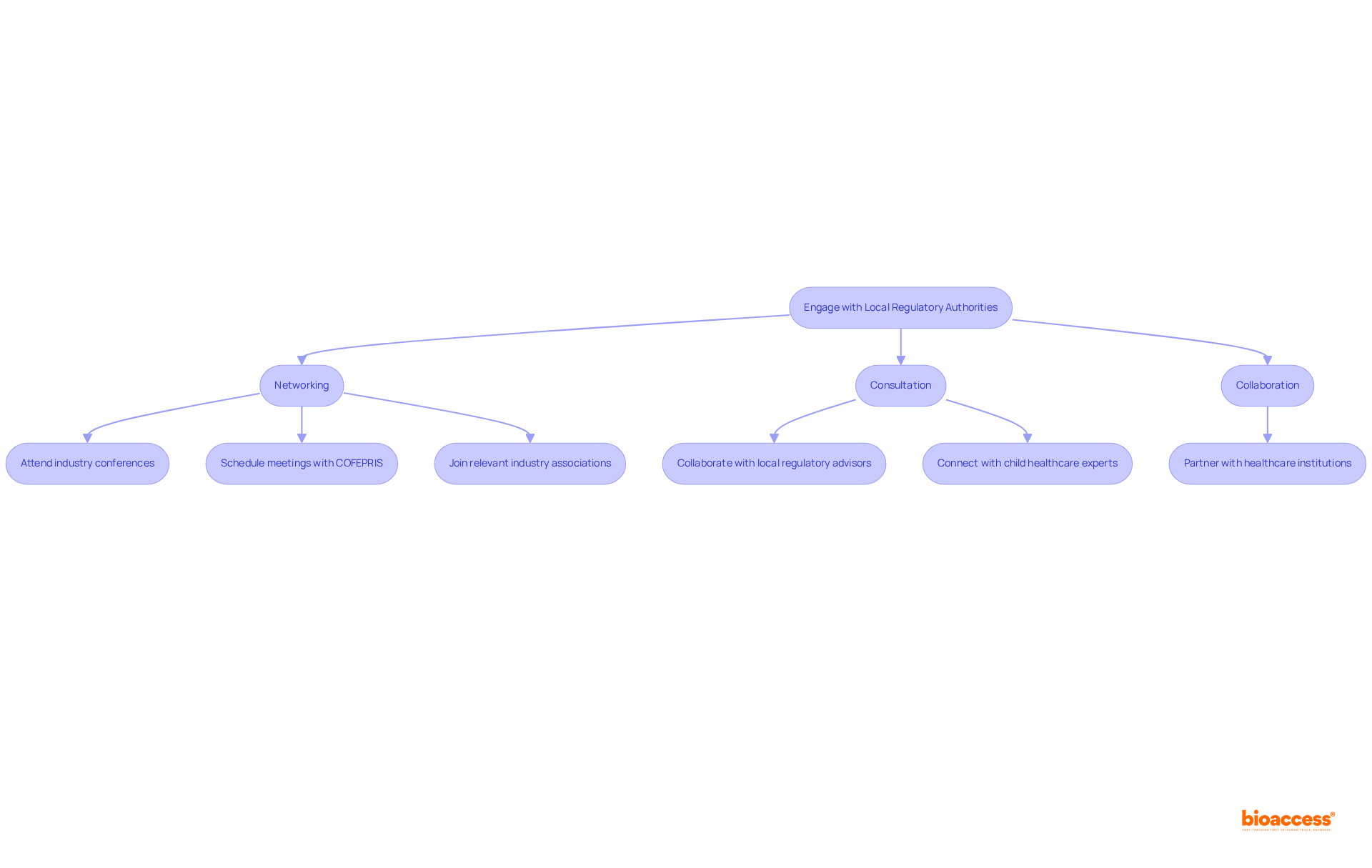

Interacting with local regulatory bodies and interested parties is crucial for navigating the pediatric device pathway Mexico advisors for children's medical products. Establishing clear communication with COFEPRIS representatives will clarify uncertainties regarding the endorsement process. Networking is vital for improving success rates in obtaining approvals for children's medical products. Consider the following strategies:

Action Steps:

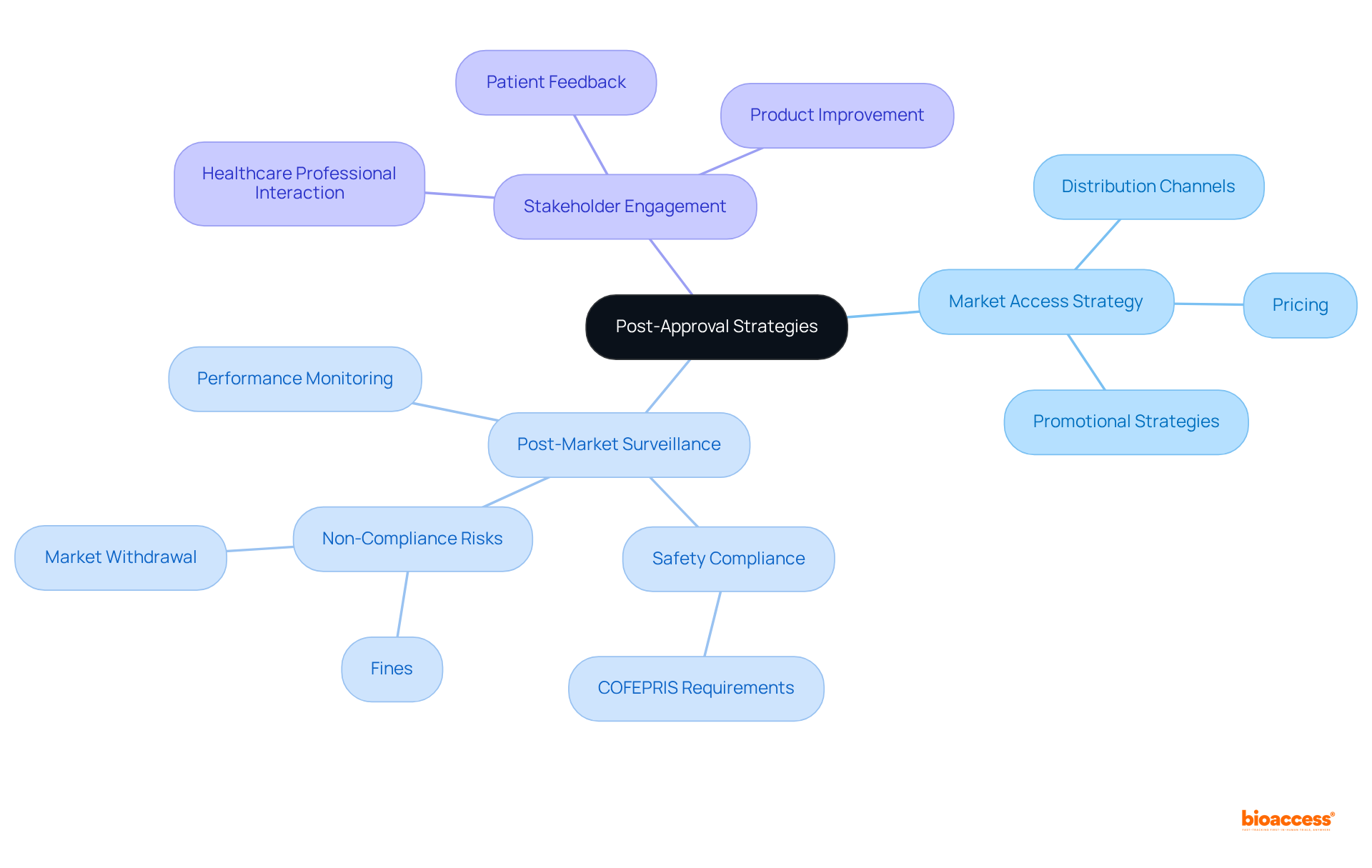

Once your children's equipment has obtained regulatory approval, executing effective post-approval strategies is essential for success in the industry. Consider the following:

Market Access Strategy: Develop a comprehensive plan that outlines how to position your device in the market, including pricing, distribution channels, and promotional strategies. With the pediatric medical equipment sector expected to attain USD 51.9 billion by 2030, a clearly outlined access strategy is crucial to leverage this expansion.

Post-Market Surveillance: Establish a system for monitoring the product's performance and safety in commerce, complying with COFEPRIS's requirements for post-market vigilance. Non-compliance can lead to significant repercussions, including fines and market withdrawal, making this a critical component of your strategy.

Stakeholder Engagement: Continue to interact with healthcare professionals and patients to collect feedback and enhance your product based on real-world usage. This engagement is especially significant in the child healthcare sector, where understanding the unique needs of children can lead to product improvements.

Action Steps:

Navigating the pediatric device pathway in Mexico necessitates a nuanced understanding of the regulatory framework and effective collaboration with experienced advisors. The insights shared underscore the importance of being well-versed in COFEPRIS regulations, ensuring proper documentation, and engaging with local authorities to streamline the approval process for children's medical products.

Key arguments highlight the critical nature of maintaining compliance through rigorous documentation, including:

Moreover, the article emphasizes the significance of post-market surveillance and stakeholder engagement to adapt products based on real-world feedback. As the pediatric medical equipment sector is poised for substantial growth, strategic planning and proactive measures are essential for successful market entry.

Ultimately, the pediatric device market in Mexico presents a wealth of opportunities for manufacturers willing to invest in understanding the regulatory landscape and fostering relationships with local stakeholders. By taking informed action and leveraging the expertise of pediatric device pathway advisors in Mexico, companies can not only comply with regulations but also enhance their product offerings, ensuring they meet the unique needs of children in healthcare settings.

What is the role of COFEPRIS in the pediatric device regulatory landscape in Mexico?

COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios) is responsible for the authorization and regulation of medical instruments, including those specifically designed for children, overseeing compliance with the General Health Law and specific directives for children's equipment.

Why is understanding equipment categorization important in Mexico's pediatric device pathway?

Equipment is classified into various risk categories, which directly impacts the authorization process. Familiarity with these categories is crucial for navigating regulatory requirements.

How often must equipment registrations be renewed in Mexico?

Equipment registrations must be renewed every five years, with the initial renewal application required to be submitted at least 150 days prior to the expiration of the current registration.

What is the significance of post-market surveillance in the pediatric device sector?

Post-market surveillance mandates robust monitoring mechanisms for product performance and safety, ensuring that products adhere to COFEPRIS regulations.

What is a Certificate of Free Sale, and why is it important?

A Certificate of Free Sale from the product's country of origin is essential for validating legal marketing in other regions, confirming that the product is authorized for sale in its country of origin.

What are the consequences of failing to report serious adverse events?

Manufacturers may face potential penalties for failing to report serious adverse events within stipulated timeframes, which is a significant compliance consideration.

What is the projected market growth for pediatric medical equipment in Mexico by 2030?

The pediatric medical equipment sector in Mexico is projected to grow from USD 513.1 million in 2023 to USD 786.0 million by 2030, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030.

What action steps can manufacturers take to navigate the pediatric device regulatory landscape effectively?

Manufacturers should review the General Health Law and COFEPRIS guidelines, determine the category of their equipment and associated authorization requirements, and stay informed about updates from COFEPRIS regarding regulations for children's equipment.